Your FNB Credit Status Fully ExplainedĪs a quick introduction, the FNB credit status report lets you know how likely you are to receive credit from FNB.įNB sources the last two years of your financial data from credit bureaus in South Africa, coupled with any other financial data FNB can obtain when deciding your final score.

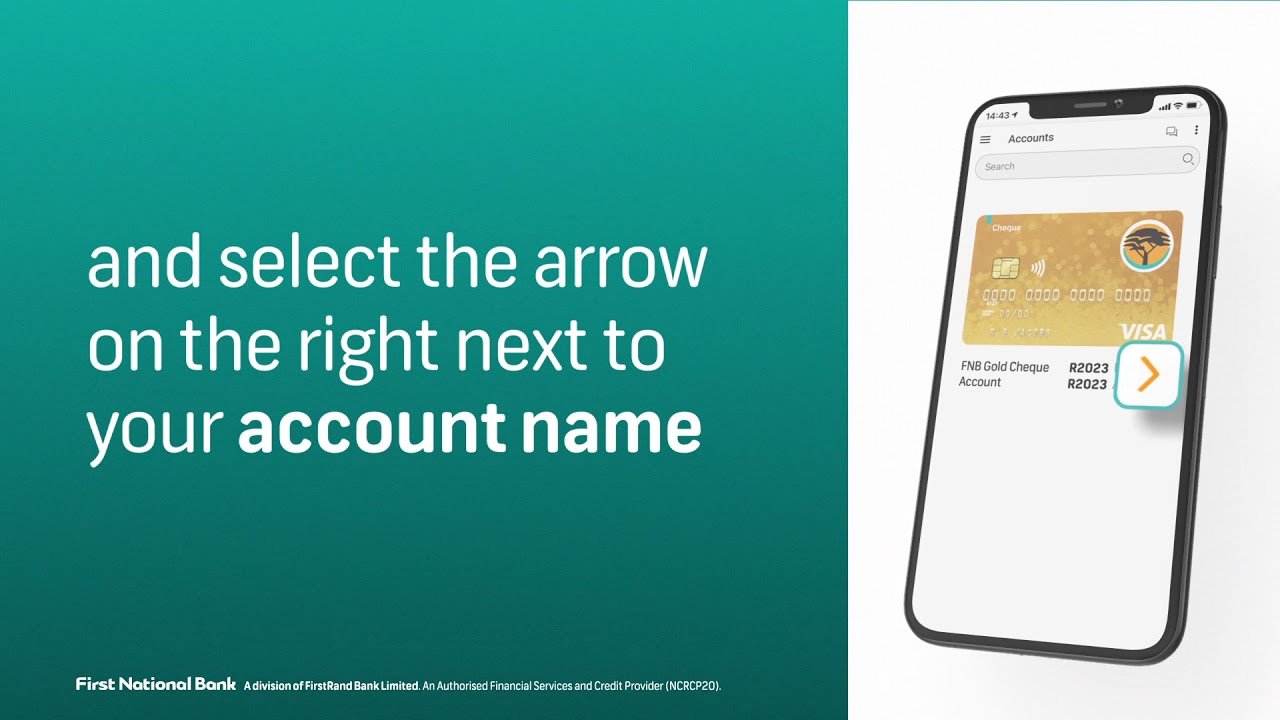

If you’re wondering exactly what this information means to you, then keep reading. Once you’re in, you’ll notice that your credit status is displayed on a line that ranges from red to green. You’ll now see your personal ‘credit status’.You might need to approve the terms and conditions of this is your first time using this feature.Finally, tap on the ‘Credit status’ tab.

Scroll down and tap on ‘nav-igate life’.

FNB APP HOW TO

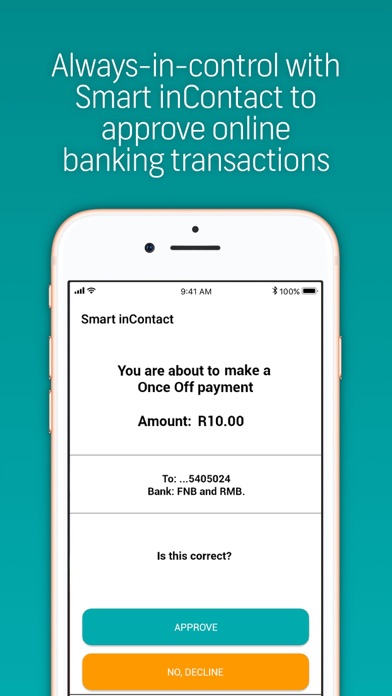

Our FNB app is the most popular digital channel for customers, accounting for 1.2 billion of the 1.7 billion total user logins,” says Celliers.Video can’t be loaded because JavaScript is disabled: How To Check Your Credit Score On The FNB Mobile Banking App (First National Bank) () “We’re also delighted to see more customers endorsing our advice-led approach to providing solutions that are helpful and easily accessible through a safer digital platform. We provided more than R600 million in alternative energy funding for commercial customers in partnership with WesBank and paid-out over R1 billion through the National Treasury-backed Bounce Back Loan scheme. “Among the many highlights are our efforts to alleviate the pressure of energy constraints on customers. Through the FNB app’s nav✼are feature, customers and employees have donated R4.4 million to early childhood development centres, old-age homes, climate change, animal welfare and housing initiatives, it notes.įurthermore, FNB says customers are rapidly embracing safer payment methods, with over R27 billion in payments made using 4.6 million virtual cards.Į-commerce activity is increasing, with the FNB app processing R18 billion in sales of third-party digital vouchers, prepaid airtime and electricity, the bank reveals.įNB CEO Jacques Celliers says: “We are pleased with our full-year performance, as it demonstrates our ability to continue supporting our individuals, families and business customers despite economic uncertainty.

In collaboration with WesBank, it adds, the nav✼ar feature facilitated nearly R600 million in vehicle finance. It says the FNB app’s nav»Home feature app originates 24% of home loans paid out to customers, and accounts for more than R52 billion in payouts since inception. The bank notes that overall transaction volumes increased by 12% to 3.6 billion, wealth and investment total assets increased by 12% to R320 billion, digitally-active customers increased by 6% to 6.89 million and digital logins totalled 1.7 billion.Īccording to the bank, FNB’s suite of fintech innovations is gaining popularity. This was disclosed in FNB’s financial results for the year ending 30 June.ĭuring the period, active customers increased by 5% to 11.49 million, while profit before tax increased by 10% to R31.4 billion. FNB’s suite of fintech innovations is gaining popularity, says the bank.īig-four bank FNB’s fintech strategy is paying dividends, with the financial institution seeing more of its customers making use of the products.

0 kommentar(er)

0 kommentar(er)